The Senior Freeze Program, formally known as the Property Tax Reimbursement Program, is designed to protect eligible seniors and disabled individuals from property tax increases on their primary residence.

This article aims to provide a comprehensive exploration of the eligibility criteria for the Senior Freeze, unraveling the complexities of the program to offer a clear, accessible guide for potential applicants.

Key Takeaways

- The Senior Freeze Program helps seniors and disabled individuals by preventing property tax increases.

- Eligibility is based on age or disability, residency, property ownership, and income limits.

- Applicants must be 65+ or receiving Social Security disability benefits, have legal residency for 10 years, and own their home for 3 years.

- Income must not exceed specific limits.

- The application process is annual, requiring timely submission of necessary documents.

- Misconceptions include age being the sole eligibility factor and the program reducing taxes, whereas it freezes them.

- Changes in eligibility status must be reported to avoid disqualification.

- The program offers financial stability and security to eligible individuals, underscoring its importance in supporting seniors and disabled persons.

Senior Freeze Program

The Senior Freeze Program is a form of financial assistance that aims to mitigate the impact of property tax increases for senior citizens and disabled individuals. By freezing the property tax amount at a certain level, the program ensures that eligible individuals are not affected by future tax hikes.

This initiative reflects the government’s recognition of the financial challenges that can accompany aging and disability, particularly on a fixed income.

Eligibility Criteria

Eligibility for the Senior Freeze Program is determined by a combination of factors related to age, residency, income, and property tax status. To qualify, applicants must meet all of the following conditions:

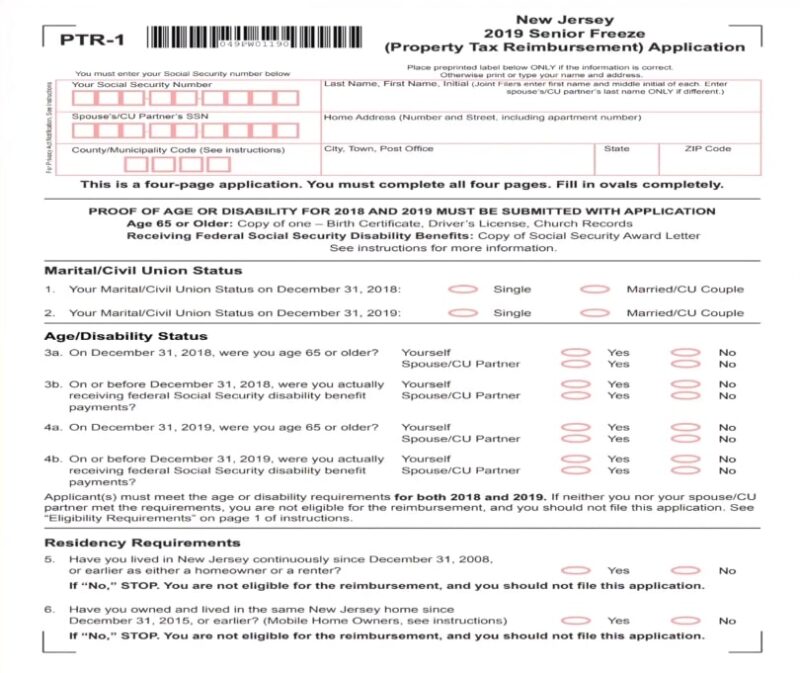

- Age and Disability Status: Applicants must be 65 years of age or older, or receiving federal Social Security disability benefits. The age criterion must be met within the calendar year for which the freeze is sought. For disabled applicants, proof of disability benefits is required.

- Residency: Applicants must have been legal residents of the jurisdiction offering the Senior Freeze for at least the last 10 years. This residency must include ownership and occupancy of the home for which the freeze is requested for at least the last three years.

- Ownership: The property for which the freeze is applied must be the primary residence of the applicant and owned by them for at least the last three years. In cases where a property is co-owned, eligibility criteria apply to all owners.

- Income Limitations: The program has strict income limits that adjust annually. Applicants must ensure their total income (from all sources) does not exceed the established threshold. This includes income from employment, investments, pensions, and any other sources.

Application Process

The application process for the Senior Freeze Program requires meticulous attention to detail and adherence to deadlines.

Applicants must annually submit a form provided by the local tax authority, along with any required supporting documentation such as proof of age, disability, income, and residency. Late applications may result in disqualification for the year.

Common Misconceptions

Several misconceptions surround the Senior Freeze Program. One common error is the belief that eligibility is solely based on age.

While age is a critical factor, the program’s comprehensive eligibility criteria encompass income, residency, and property ownership as well.

Navigating Changes in Eligibility

Participants in the Senior Freeze Program need to report any changes in eligibility status, such as increases in income, changes in property ownership, or alterations in residency.

Failure to report such changes can lead to disqualification and the requirement to repay any benefits improperly received.

The Impact of the Senior Freeze

The Senior Freeze Program can have a profound impact on the financial well-being of seniors and disabled individuals. By stabilizing property tax bills, it helps eligible individuals maintain their homes and manage their finances more effectively in the face of rising living costs.

This stability is crucial for those on fixed incomes, providing peace of mind and financial security.

FAQs

Final Words

The Senior Freeze Program represents a critical safety net for seniors and disabled individuals, offering protection against the financial strain of increasing property taxes. Understanding the eligibility criteria is the first step toward accessing this valuable benefit.

With careful attention to the application process and compliance with the program’s requirements, eligible individuals can secure much-needed relief, ensuring their ability to remain in their homes and manage their finances with greater ease. The Senior Freeze exemplifies the broader effort to support vulnerable populations, reflecting a commitment to the well-being of seniors and disabled persons within the community.